Wych

As the UX Designer & Researcher, I focused on redesigning the onboarding experience to encourage user adoption while addressing trust and security concerns. The goal was to create a seamless and secure process that would motivate users to link their financial accounts and explore the app’s budgeting and savings features.

Key Achievements at Wych

Conducted Extensive User Research:

Interviewed 8 remote users to understand their financial management habits and concerns.

Identified key behaviors, including interest in budget tracking and security concerns around financial data sharing.

Designed and Tested Concepts:

Developed four divergent concepts focused on user goals, data security, and trust-building during onboarding.

Conducted 7 remote concept tests to gather feedback on the design directions.

Developed Key Personas and Problem Statements:

Created a primary user persona to represent busy working millennials who need a simple solution to manage finances and save money efficiently.

Defined the core problem as a need for streamlined financial management to reduce debt and improve savings.

Prototyping and Usability Testing:

Tested the prototypes with 14 users, identifying areas of confusion such as button placement and unclear interactions.

Iterated on the prototype based on feedback to improve usability and trust.

Market and Competitor Analysis:

Evaluated financial assistant apps, virtual banks, and behavior-change apps to uncover opportunities for Wych.

Approach

Research & Discovery

Conducted user interviews to understand financial management behaviors, revealing that:

87% of participants were interested in Wych’s features.

50% of UK adults exhibited signs of financial vulnerability.

Most users were interested in budget tracking but had concerns about data security.

Completed competitor analysis focusing on financial apps and virtual banks to identify feature gaps and best practices.

Collaborated with stakeholders through workshops to align expectations and gather business insights.

Problem Statement

"Busy working millennials want a simple, efficient way to manage all their finances in one place to avoid debt, maximize savings, and gain a better financial overview."

Persona Development

Created the persona Alex, representing millennial users seeking effortless financial management but struggling to meet savings goals.

Design & Prototyping

Concept Exploration

Developed four divergent concepts focused on:

Goal-Oriented Onboarding: Highlighted how the app helps users meet savings targets.

Building Trust: Emphasized transparency in data usage.

Security Features: Allowed users to choose security options like PIN and biometrics.

Personalization: Provided previews of personalized budgeting features.

Prototyping & Testing

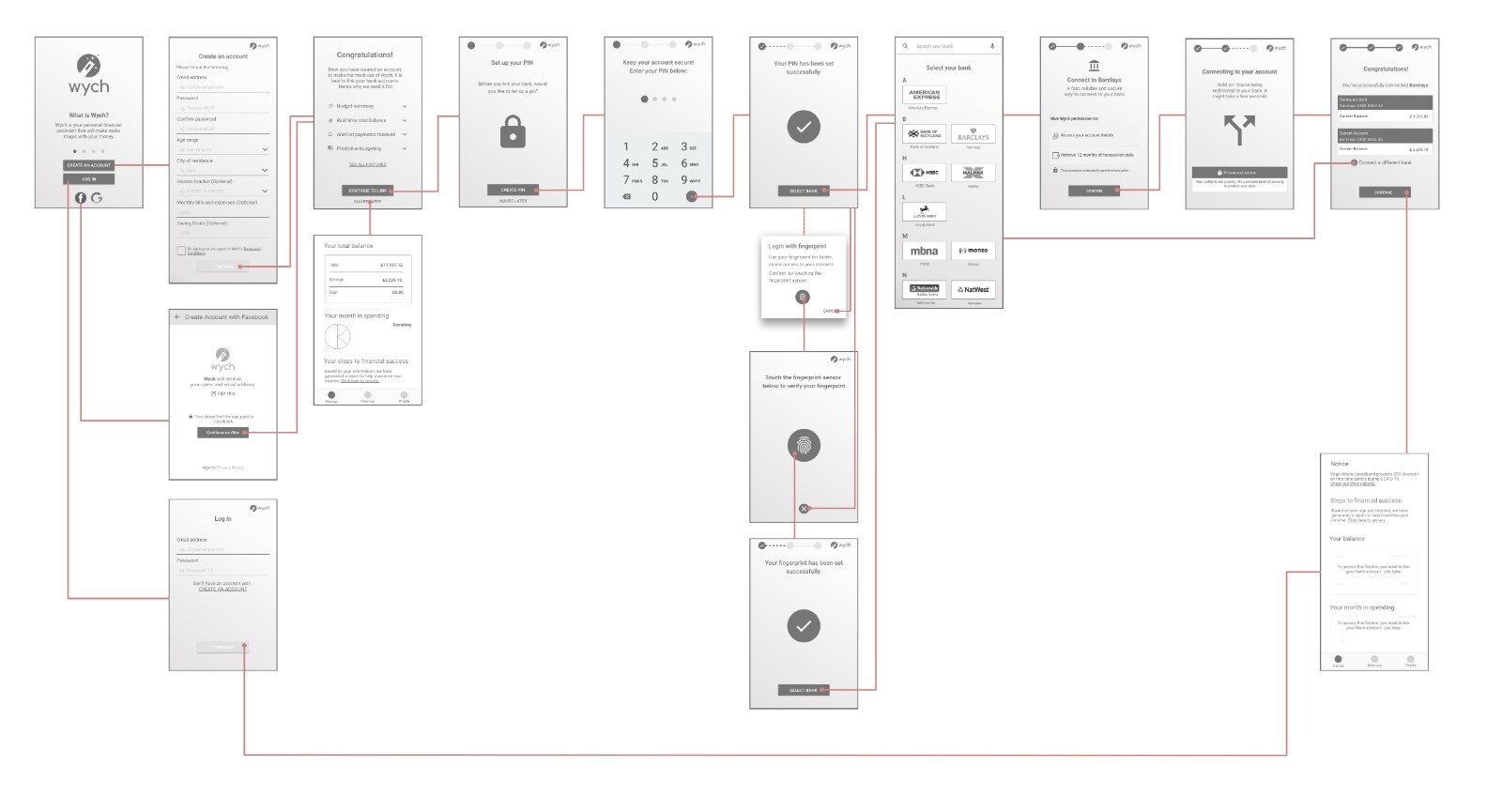

Built mid-fidelity wireframes using Adobe XD.

Conducted usability testing with 14 participants, which revealed:

Confusion around button placement and interaction cues.

Positive reception to goal-oriented onboarding.

Reassurance provided by visible security options, though placement needed adjustment.

Design Solutions

1. Onboarding Flow Redesign:

Streamlined the account setup process with clear goal-setting steps.

Included early previews of budgeting features to showcase app value.

2. Enhanced Trust & Security:

Added transparent messaging around data privacy.

Integrated optional security features like PIN codes and biometric login.

3. Improved Navigation & Visual Hierarchy:

Reorganised screens to reduce cognitive load.

Enhanced visual cues to guide users through onboarding seamlessly.

Results & Impact

Improved User Engagement:

Users expressed increased willingness to link accounts after onboarding improvements.

Enhanced Trust & Security Perception:

Transparent data usage explanations reassured users and reduced privacy concerns.

Streamlined Navigation:

Iterative design changes improved task completion rates and reduced onboarding drop-offs.

Positive Client Feedback:

The redesigned onboarding process received praise for aligning with user needs and business goals within the tight 4-week timeline.

Future Recommendations

Further refine customer-facing language to balance friendliness and professionalism.

Implement bottom navigation for improved usability.

Offer onboarding previews for users hesitant to share financial information immediately.